The SDG Impact Standards for Bond Issuers are for all bond issuers regardless of size, geography or sector, who want to contribute positively to sustainable development and the SDGs. This includes:

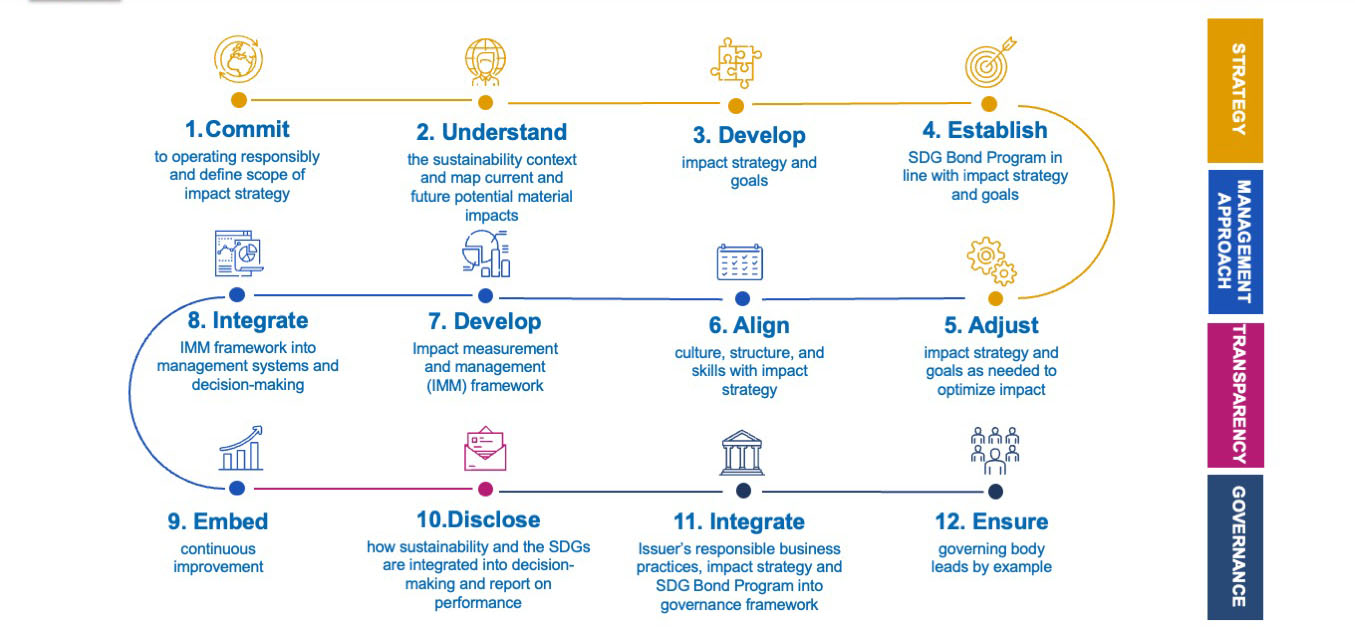

The SDG Impact Standards for Bond Issuers set out an internal decision-making framework to help this group develop and implement an impact strategy to contribute positively to sustainable development in line with the SDGs. It enables bond issuers to link their impact strategy to the SDG Bond Program and their organization-wide strategy. Within the scope of the defined impact strategy, this set of Standards help Bond Issuers direct attention and resources to where they can optimize their SDG contribution by focusing on all material positive and negative impacts on people and planet. Embedding the SDG Impact Standards into management decision-making will strengthen impact performance and facilitate higher quality and more consistent disclosures.

Download About the SDG Impact Standards

Download the FAQs

Download the Glossary

Download the SDG Impact Standards for Bond Issuers version 1.0

Download Standards Guidance for the SDG Impact Standards for Bond Issuers

Download the SDG Impact Self-assessment tool for Bond Issuers

Download the response to the most recent consultation input

Download the Glossary

Download the SDG Impact Standards for Bond Issuers version 1.0 in Korean

Download the SDG Impact Standards for Bond Issuers version 1.0 in Mandarin Chinese

Download the SDG Impact Standards for Bond Issuers version 1.0 in Spanish

The SDG Impact Standards are grounded in high level principles and provide context for integrating other tools and frameworks into decision-making. Read the SDG Impact Standards Mapping Document to see how the UNDP’s SDG Impact Standards for Private Equity Funds have been developed to support the application of the Operating Principles for Impact Management.

A mapping document illustrating how Operating Principles for Impact Management map to the SDG Impact Standards for Private Equity Funds can be found here.

Footnotes:

1- Operating Principles for Impact Management, UNEP FI's Principles for Positive Impact Finance and Responsible Banking Principles, Principles for Responsible Investment, Social Value International's Social Value Principles, and GIIN Core Characteristics of Impact Investors.

2- Integrating UN Guiding Principles for Business and Human Rights, Ten Principles of UN Global Compact and Impact Management Project shared norms, and contributing positively to sustainable development and achieving the SDGs.

3- For instance, metrics, taxonomies, valuation models, benchmarking tools e.q. IRIS+, GRI, UNCTAD metrics, Voluntary National Reviews (VNRs) on the implementation of the SDGs, SDG Impact Market Intelligence Investor Maps, Nationally Determined Contributions (NDCs) to the Paris Accord, OECD Guidelines for Multinational Enterprises, Capitals Coalition Natural and Social and Human Capitals Protocols, SVI Standards, Blab SDG Action Manager and UNEP FI Impact Analysis Tools.

4- For instance, Integrated

Voluntary independent use

The Standards are provided to Bond Issuers as a ‘best practice’ guide to help them align their internal processes to integrate impact management into decision-making. Bond Issuers are encouraged to use the Standards in their entirety as a gap analysis and self-assessment tool, and to fill gaps and improve practice over time.

Assurance protocols and SDG Impact Seal

An external assurance framework and SDG Impact Seal are being developed in tandem with the Standards. Bond Issuers are highly recommended to move from self-assessment to having their impact management practices assured at regular intervals by an independent accredited assurer.

Complementary resources

UNDP is complementing the SDG Impact Standards with additional resources, including a glossary, guidance notes, online training on impact management is now available with the UNDP-Duke University Impact Measurement and Management for the SDGs course, free on Coursera. An accreditation process will build additional capacity, capability, and consistency within the assurance community.

The consultation process meets the process required for UNDP Principles for social and environmental standards. The SDG Impact Standards for Bond Issuers have undergone two rounds of public consultation. The first consultation period was between April and July of 2020 and the second was during the November 2020 and January 2021. We thank everyone who submitted feedback.

A public report documenting the feedback received during SDG Impact’s response to the second consultation can be found here.

Sustainable Development Goals © 2022 SDG Impact Terms and Conditions