Asia is home to over 60% of the world’s population and to 61% of the world’s poorest (classified as living under USD 6.85 poverty line a day 2017, PPP). The historical gains made towards the SDGs were quickly reversed by COVID -19 pandemic which hit the region with severe economic and social repercussions. Education, healthcare and food security sectors were hit hardest. With the climate crisis on our doorstep and persistent layers of inequality and gender disparities enveloping this new socio-economic reality, the task at hand is urgent.

Availability and access to steady and predictable finance flows is required to outpace these challenges. Currently, the global assets under management (AUM) for impact investments amounts to just USD 1.64 trillion – a mere 1.5% of the estimated global AUM of USD 112 trillion as of 2021. Financing therefore needs to be intentional, sustained and with every actor in the capital market committed to accelerate capital towards the SDGs, where sustainable investing is mainstream and not just a niche asset class.

To help private investors direct more capital towards sustainable development, UNDP Sustainable Finance Hub (UNDP SFH) produces SDG Investor Maps. These are market intelligence databases that identify the sweet spot between policy momentum, performance on SDG commitments and private sector interest in emerging economies. The SDG Investor Maps put the pin on investment opportunities where capital flows can help achieve commercial returns and have the potential to create deep development impact. The resultant market intelligence helps weld together investment and impact theses to show that doing business can also mean doing good for people and the planet.

In Asia, the SDG Investor Maps are based on an in-depth body of work that has involved countless hours of research and over 300+ structured consultations with in-country government and private sector stakeholders. We have seen how such market intelligence is making a difference in informing private investors, policymakers and businesses on the ground within the sectors that need capital to outpace development challenges purposefully and sustainably.

To date, over 30 SDG Investor Maps have launched across Asia, Africa, Middle East and Latin America of which 9 are from Asia (Cambodia, China, India, Indonesia, Malaysia, Sri Lanka, Thailand and Viet Nam). They contribute to bringing sustainability to the heart of global finance – from both the public and private sectors.

Here are some highlights from the Asia SDG Investor Maps:

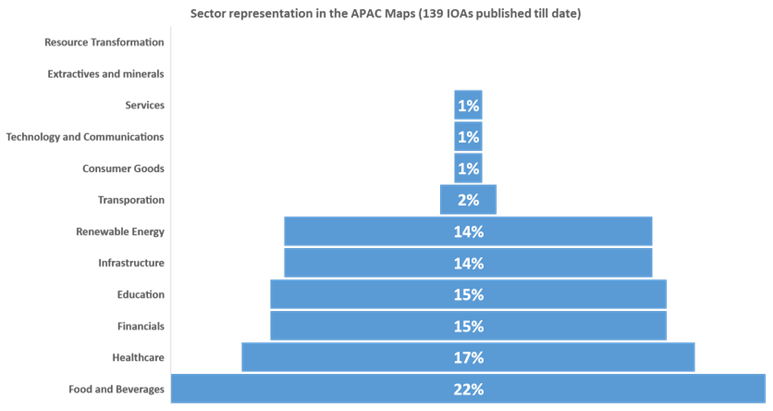

1. Agriculture, Education, Healthcare and Renewables are emergent priority sectors: Despite socio-economic and cultural differences, a pattern is emerging in terms of the priority sectors and sub-sectors in Asia. Furthermore, nearly half (47%) of the investment opportunities identified so far use tech-based business models to solve development challenges.

a. Agriculture, constitutes over a fifth (22%) of the total opportunities identified in the Asia SDG Investor Maps, not surprising, given that it provides livelihood to 67% of the workforce in Asia of which a significant proportion are women.

b. Education and Healthcare (15% and 17% respectively of total opportunities identified) emerge as priorities since many countries in the region still stand to benefit from their demographic dividend for which the quality of human capital is a key determinant of success. COVID-19 has adversely impacted both these sectors but has also pushed the private sector to innovate disruptive solutions leveraging technology. National governments have responded in equal measure by prioritizing digitalization and bolstering digital infrastructure.

c. Renewable Energy is a strong sector representing 14% of total investment opportunities identified, with policy momentum around Nationally Determined Contributions (NDCs) pushing governments to create the right incentives for the private sector to participate meaningfully.

Source: SDG Investor Platform and UNDP Research (as of May 2023)

2. High quality pipeline of investable, SDG-focused enterprises is scarce: Conversations and in-depth interviews with different investor types (VCs, PEs, DFIs, pension funds, banks) show that fund managers are increasingly looking at embedding sustainability at the portfolio level and by extension in their investment into companies. This shift is informed by regulations in some markets (albeit focused mostly on climate), by increasing sustainability related accountability demanded by consumers and employees and by urgency to remain relevant in the face of an unpredictable future. Therefore, the challenge is now to spotlight enterprises within SDG-enabling sectors/sub-sectors and investment opportunities, that can attract deal flows.

3. Funds’ impact narrative ̶ by design or an afterthought? It has been encouraging to engage with funds that are and have a clear impact thesis including clarity on specific levels of business value chain they want to address within focus sectors. These are typically the impact investors who have built impact into their systems and processes. However, most that participated in our consultations, and form a larger share of private capital deployments within a national context, remain sector-agnostic and have maintained that it is important for them to make the right deal choice within a sector or industry to ensure deal success. Oftentimes, the fact that these choices may also be SDG-enabling and impact-focused, is incidental.

4. Impact data needs to be scientific and consistent: The flow of transactions cannot be conflated with impact. A strong data management system that allows comparable output and outcomes data to be collected and reported, in a shared vocabulary between enterprises and funds. This is critical for the shift from simply committing to the SDGs to then enabling the SDGs using sound management practices that are backed by impact-focused decision making.

5. Data from Asia and of Asia: Asian economies are at vastly different stages of development, but all share immense growth potential. As a global hub of manufacturing and trade, as well as one of the fastest-growing consumer markets in the world, the region seeks to deepen its ties and capture an even greater share of the global market. Despite COVID-19 induced setbacks, the region’s economic profile is promising, and it is crucial for those outside the region to understand its complexities and contradictions. Hence, data and insights from the region need to be placed in its socio-economic, policy, regulatory context and should bring out the nuances and variation within which investment decisions can be made.

6. White spaces and the role of concessionary finance: Consultations with sector experts, investors and enterprises have also led to the identification of ‘white spaces’ across Asian SDG Investor Maps. ‘White spaces’ are areas that are yet to have fully developed market conditions from a policy standpoint or from the perspective of demand side readiness for a product or service. The solutions to address these gaps can be mobilized through policy dialogues and concessional capital to de-risk investments that can lower the entry barriers for the private sector- we will explore more of this in a future blog.

We now see that the SDG Investor Map is part of a larger value chain in the sustainable finance spectrum. The resultant market intelligence needs to be linked with other activities to increase the likelihood of actual transactions in the identified investment opportunities.

Ecosystem development to influence behavior change among key actors - starting with regulators to fund managers, to businesses – all, will be key in institutionalizing SDGs as core to the way business and investment is done.

An underpinning driver in achieving transactional outcomes will be SDG-enabling decision-making and a deliberate shift to commit to an increase in capital flows to the SDGs.

Our SDG Investor Maps provide a wireframe for ‘what’s next?’ after they are launched. As Einstein famously stated, ‘We cannot solve our problems with the same level of thinking that created them’. The road ahead, while daunting, is one that is necessary and needs a serious effort to pivot from traditional approaches, with all actors coming together to ensure that the impact thesis is truly integrated into the investment thesis for businesses and investors. Asia is key to this transformation.

Visit the SDG Investor Platform to access 500+ Investment Opportunity Areas in over 30 markets.

Written by- Devahuti Choudhury SDG Impact Specialist for APAC, UNDP Sustainable Finance Hub

Sustainable Development Goals © 2023 SDG Impact Terms and Conditions