Authors:

Fabienne Michaux, Director, UNDP SDG Impact. Fabienne Michaux is the Director of UNDP SDG Impact, lead developer of the SDG Impact Standards and a Working Group Member of the G7 Impact Taskforce. SDG Impact is a UNDP Sustainable Finance Hub initiative working to accelerate private sector contributions towards the achievement of the Sustainable Development Goals (SDGs) by 2030 and beyond

Robyn Oates, Financial Specialist, UN Women. Robyn Oates is a Finance Specialist at UN Women, managing UN Women’s Sustainable Finance team which focuses on developing gender responsive financing instruments, standard setting, and market building.

UN Women is the United Nations entity dedicated to gender equality and the empowerment of women. A global champion for women and girls, UN Women was established to accelerate progress on meeting their needs worldwide.

As we mark International Women’s Day in 2022, the global community is grappling with world-spread crises including the COVID-19 pandemic and climate change. Women and girls are disproportionately affected by both. Decades of progress is being rolled back and countries are not on track to meet SDG 5: Gender Equality and Women’s Empowerment by 2030.

Women are leaving the workforce; girls are dropping out of school in higher numbers and both women and girls face increased burdens of unpaid care work. A staggering rise in gender based violence, dubbed the “shadow pandemic” is occurring world-wide. Despite this, the UNDP-UN Women COVID-19 Global Gender Response Tracker reveals that globally only 13 per cent of social protection and job responses to the pandemic have targeted women’s economic security and only 11 per cent provides support for unpaid care. At the same time, climate-related disasters account for 30 million newly displaced people as identified by the Internal Displacement Monitoring Centre, Global Report on Internal Displacement 2021 (Geneva), which exacerbate the risks faced by women and girls, such as early marriage and reduced access to education.

Never have the interdependencies between economic, social and environmental outcomes been so apparent. Failing to achieve SDG 5 remains a binding constraint to achieving all other SDGs and on our collective economic potential. The Council on Foreign Relations notes that by closing the gender gap in the workforce, our global economy could increase by 26%.

There is a growing consensus that we need to act. Yet, there is a significant gap between this growing awareness and tangible actions that will result in better outcomes. Despite the exponential rise in ESG related investments (over $35 trillion in 2020 and are projected to reach beyond $50 trillion by 2025 according to Bloomberg Intelligence) we are no closer to achieving the SDGs. The COVID-19 pandemic has increased the annual SDG financing gap to $3.7 trillion in 2020, up from $2.5 trillion in 2019 (OECD) – a drop in the ocean compared to the claimed ESG investment universe. Commenting on the World Benchmarking Alliance’s (WBA) findings from its Social Transformation Baseline Assessment of 1,000 companies from its SDG2000 index launched in January 2022, Dan Neale, Social Transformation Lead at WBA said, “Businesses are, overall, on course to entrench, rather than end, the social inequalities that pose a global systemic risk and their inability to put people at the heart of their thinking also undermines efforts to address the risks of climate change and biodiversity loss.”

Why the disconnect? In part, because we select metrics with the sole purpose of reporting to external stakeholders and lowering the cost of capital. We select metrics that are readily and easily available, limiting our reporting to the “up-side” while overlooking unintended, negative, or harmful implications.

Data disaggregation (age, gender, race) – a fundamental component in decision-making and accountability – remains woefully lacking and underutilised. Key insights remain lost in averages, the needs and preferences of underrepresented stakeholders – including women are not considered. Outcomes continue to be assessed in siloes, rather than holistically. The inter-connectedness of gender and climate is a prime example; women’s greater dependence on and unequal access to natural resources, public services and infrastructure mean that they are disproportionately affected by environmental degradation and climate change. In turn, gender inequality and the unequal access of women to land and natural resources, finance, technology, knowledge, mobility, and other assets constrain the ability of women to respond and cope in contexts of climate and environmental crises.

To address these challenges, we need a transformational shift that places inclusive sustainability at the centre of all public and private sectors’ incentive structures, decision making and management processes. We need a transparent assessment of the measurement metrics to ensure that sustainability becomes the way business and investments are done and not merely and add-on to what gets done.

Second, we need financing instruments that reinforce accountability and transparency and increase credible capital flows towards the SDGs.

Two recent initiatives within the UN system are addressing these needs.

UNDP’s SDG Impact Standards (the Standards) were created to help businesses and investors put sustainability and the SDGs, including SDG 5 at the core of management and investment decision-making. Four sets of standards have been launched so far – for enterprises, bond issers, private equity funds and the OECD/UNDP Impact Standards for Financing Sustainable Development.

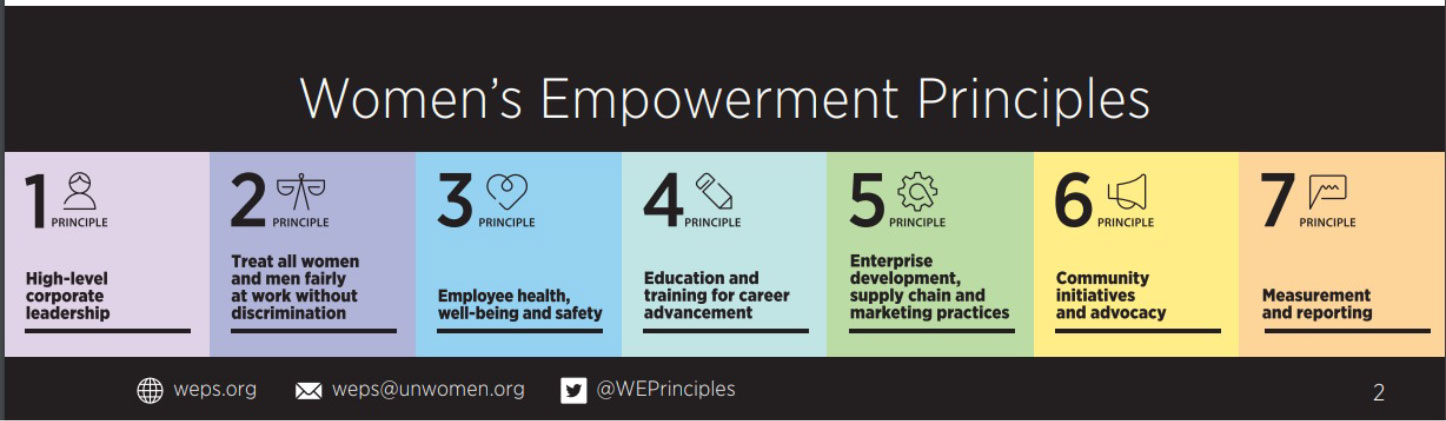

These voluntary standards can guide investors and businesses in a comprehensive gap analysis on sustainable practices and actions that can be taken to move then towards best-practice over time. Underpinning the Standards are core, principle-based frameworks – including the UN Women’s Empowerment Principles (UN WEPs) - which are used by over 6,000 businesses and investors to address gender equality and women’s empowerment in the workplace, marketplace and community. The UN WEPs provides the tools needed to conduct a gender gap analysis, create a gender action plan and supports transparent reporting on progress on gender equality. A 2021 UN Women study on companies in G7 countries reporting on 17 WEPs indicators, shows companies that have publicly committed to the WEPs generally perform better than those that have not in 12 different indicators.

Recognizing the need to strengthen impact integrity, market trust and confidence, an Assurance Framework based on the SDG Impact Standards will be launched later this year. It will provide a consistent and transparent framework against which accredited assurers can assess users’ conformance to minimum thresholds based on the Standards. It will also verify their commitment to, and progress towards, continuous improvement in line with the Standards. Users that satisfy the requirements will be eligible to apply to use the SDG Impact Seal.

In November 2021, UN Women, IFC and the International Capital Market Association (ICMA) issued the first global guideline for gender responsive sustainable debt. “Bonds to Bridge the Gender Gap: A Practitioner’s Guide to Using Sustainable Debt for Gender Equality” aligns with the existing ICMA thematic Bond Principles and provides practical guidance to both the public and private markets on how to use thematic bond issuances to advance gender equality.

As the largest financial market, the global debt capital markets can play a defining role in driving finance toward gender equality in both the public and private sectors. For issuers, gender themed thematic bonds offer an opportunity to lead on advancing gender equality, diversify their investor base, as well as define and communicate their commitment to the market. With the exponential increase in thematic debt issuances, integrating a credible gender lens into the bond and reporting framework is key to ensuring sustainable bonds lead to transformative impact.

Following the issuance of these guidelines, UN Women is supporting a number of governments and private sector actors to create robust and credible frameworks to underpin their thematic issuances and is supporting the development of monitoring and reporting mechanisms which increase transparency and accountability between issuers, investors and key stakeholders.

Adopting the UNDP SDG Impact Standards, leveraging the UN WEPS framework and ensuring thematic debt issuances contain credible and measurable gender equality considerations are concrete ways, the investment and business community can translate their pledges to positive impact in 2022 and beyond. In this new paradigm, we move the numbers in the right direction towards a more sustainable, resilient, and equitable future for all.

A version of this article first appeared in Responsible Investor

Sustainable Development Goals © 2022 SDG Impact Terms and Conditions